Mobile banking and payments are widely prevalent due to their convenience and the rising demand of digital-savvy millennials and GenZers. This culture shift keeps the Banking and Financial Services sector “on their toes in offering advanced features in their mobile payment offerings. After all, an increasing number of consumers regularly use mobile apps to perform day-to-day transactions. Per recent data, mobile payments account for more than 94% of the total ~16.9 Billion digital transactions.

Current Mobile Payment Trends

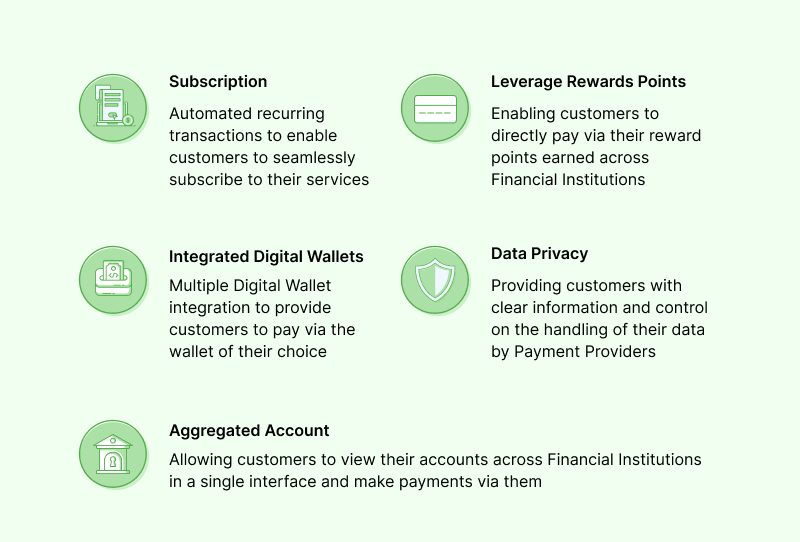

Most digital solutions have integrated mobile payments for a better customer experience. However, let’s see some of the features that are gaining traction in the payments space.

- Subscription – Payment platforms have provisions to execute automated recurring transactions on various payment modes empowering customers to seamlessly subscribe to their preferred services.

- Leverage rewards points – Recently banks and card providers have affiliated with FinTech partners who aggregate reward points from different brands and banks and allow customers to directly pay via their reward points.

- Integrated digital wallets – Payment platforms currently integrate with multiple digital wallets to provide options for the customers to choose the wallet of their choice while completing their payments.

- Aggregated accounts – With customers having accounts with various financial institutions, payment platforms have lately enabled them to view all their accounts aggregated in a single interface and make payments via them.

- Data privacy – Payment providers now provide better in-app data control and clearly highlight what data is being retained and how secure they are being stored in order to ensure better security and privacy to the customers.

How We Matched Up The Expectation

Alongside implementing the payments journey for best-in-class Banking, Lending, and Capital Markets applications for some of the large financial institutions, we realized that providing a superior and consistent user experience requires a solution with the perfect blend of experience, function, and technology.

Our team of technology experts, and ‘experience engineers’ ensure that we deliver robust and reliable solutions with superior experience by building it for Experience, Exception & Scale. The following are the ways we have improved the mobile payment experiences.

By building for Experience, we ensure our apps provide users with a seamless, easy, and uniform experience for users across all digital channels. In addition, our understanding of the fast-evolving fintech landscape and today’s sophisticated customer expectations help us to incorporate the following UX elements to improve the overall payments experience from a user perspective.

- Seamless and straightforward user journey to reduce payment abandonment due to complex interfaces

- Providing clear payment information and Call To Action (CTAs)

- UI elements that highlight security and privacy aspects to assure users that they are transacting via a secure channel

- Highlighting and prioritizing their preferred transaction mode from their previous transactions

There are specific scenarios where users want certain features from the app at different stages of their journey, and the companies need help with technical limitations of their core systems. We have solved similar scenarios by handling the Exceptions of the core systems with our Customer Experience Management platform. The following are some of the features handled by our CXM in the payment’s solution context.

- Integrating multiple payment gateways and payment options to provide a wide range of payment options to the users

- Logging all transactions from multiple payment gateways in a single source for audit and compliance purposes.

- Payment option suggestions based on payment history and success rate of the payment mode

Scalability is one of the critical elements, especially while developing sophisticated and mission-critical solutions for the banking and financial services sector. Unfortunately, scalability is a key factor leading to payment failures, especially during peak traffic. The following are the enhancements on the CXM to mitigate the scalability issues:

- Load balancing and routing payments via multiple payment gateway instances

- Active routing of payments based on the success rate of the payment gateway

- Automated retry of payments in case of payment failure

To Summarize

Smartphones have become a necessity and define our current life. Hence, mobile apps must be innovative and deliver a seamless experience with a superior solution. So, analyze your financial solution or app in detail from an experience perspective and decide if it is robust, intuitive, and innovative to provide an enhanced customer experience. Then, if you need a Digital Solution to engage your customer and improve your business efficiency, reach us at Market Simplified for a world-class financial solution. Our award-winning team of experienced consultants and development experts adopt the best in industry practices and innovation, thus giving you a competitive advantage.

;)