Creating value

A simplified digital banking platform is the need of the hour. It helps banks to grow and expand their business and acquire new customers irrespective of the internet generation they belong. Our client was one of the largest private banks in India that required a sophisticated yet easy-to-use digital banking platform to engage with their customers meaningfully. With more than 16K branches across 780+ locations worldwide and over 30 million customers, they required an efficient Customer Experience Management Platform.

Seizing the chance to deliver

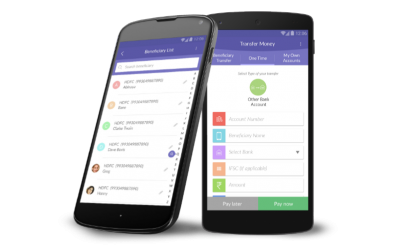

Market Simplified partnered with the bank to redefine the UX of their mobile banking app and transform them into a connected Super App that supports ever-changing business needs and consumer behaviour. They required a fresh perspective and analysis of their current digital capabilities.

We built India’s first digital customer self-onboarding platform and full-service digital banking ecosystem. The bank required an end-to-end solution provider for concept thinking, solutions, design, mobile banking development, user and transaction management and secured native mobile and tablet applications.

Driven to overcome challenges

The critical business requirements from the bank demanded a digital platform connecting multiple core systems and providing a seamless user experience for customers across various products.

Some of the other challenges the bank faced include:

- Scalability

- Ability to configure the platform for mobile banking channels to manage users

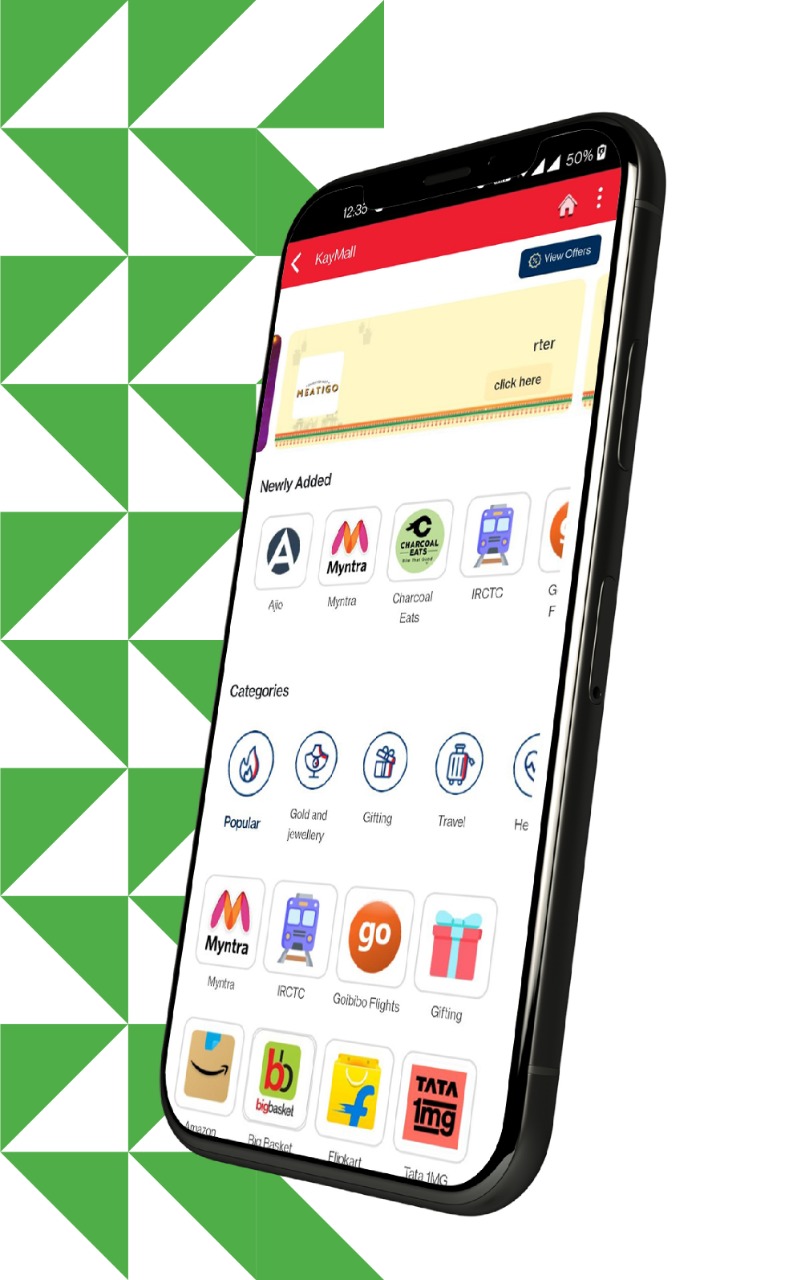

- M-commerce integration capability

Driven to overcome challenges

The critical business requirements from the bank demanded a digital platform connecting multiple core systems and providing a seamless user experience for customers across various products.

Some of the other challenges the bank faced include:

- Scalability

- Ability to configure the platform for mobile banking channels to manage users

- M-commerce integration capability

Redefining Customer Experience

Digitalisation was integral to the bank’s growth strategy focused on customer acquisition, engagement, and experience. They wanted to drive a connected experience for their customers and redefine the customer experience by harnessing the power of the latest digital advancements. Here’s the solution we delivered:

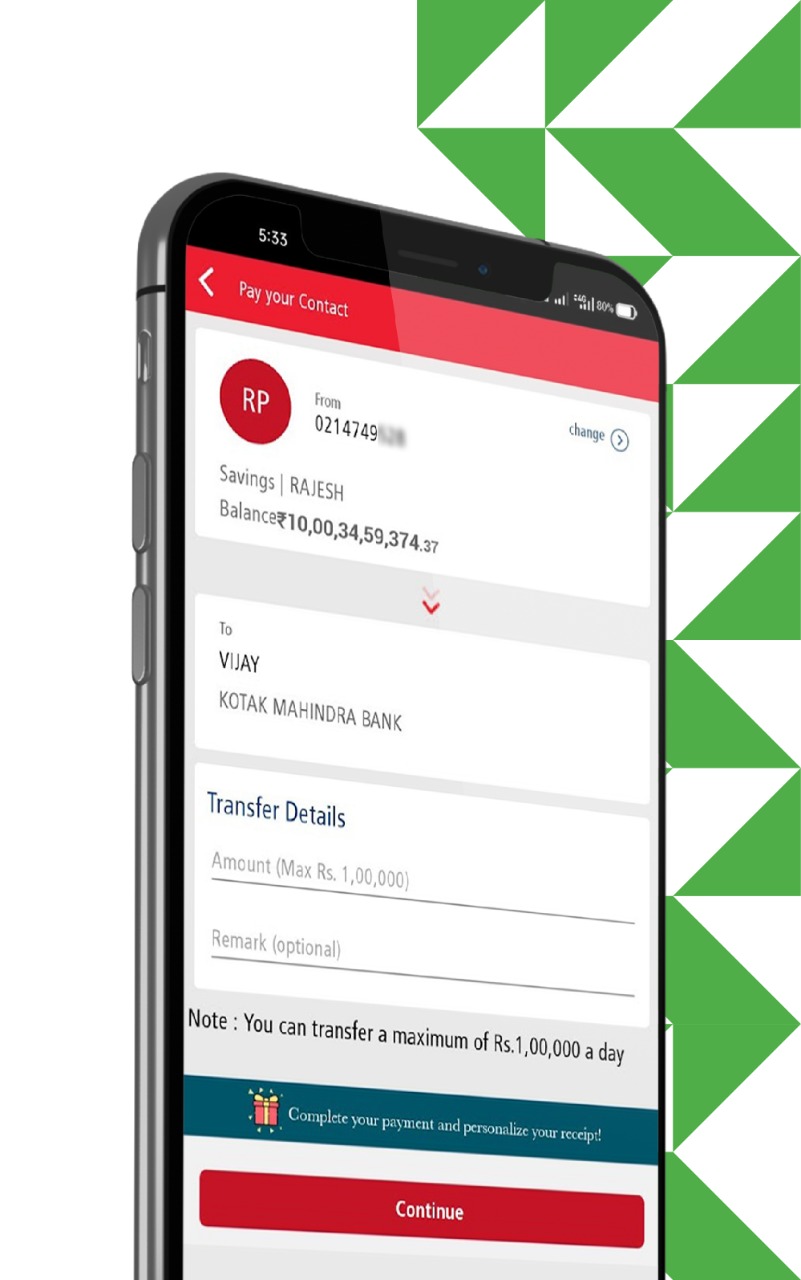

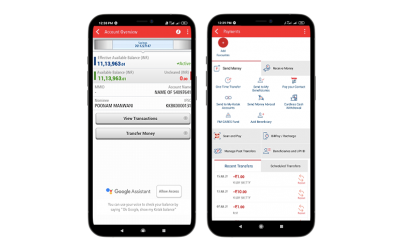

- Redefined user experience of the mobile banking app with customers at the centre of the design

- Implemented a robust and secure Customer Experience Management Platform

- Built India’s first digital customer self-onboarding platform and full-service digital banking ecosystem

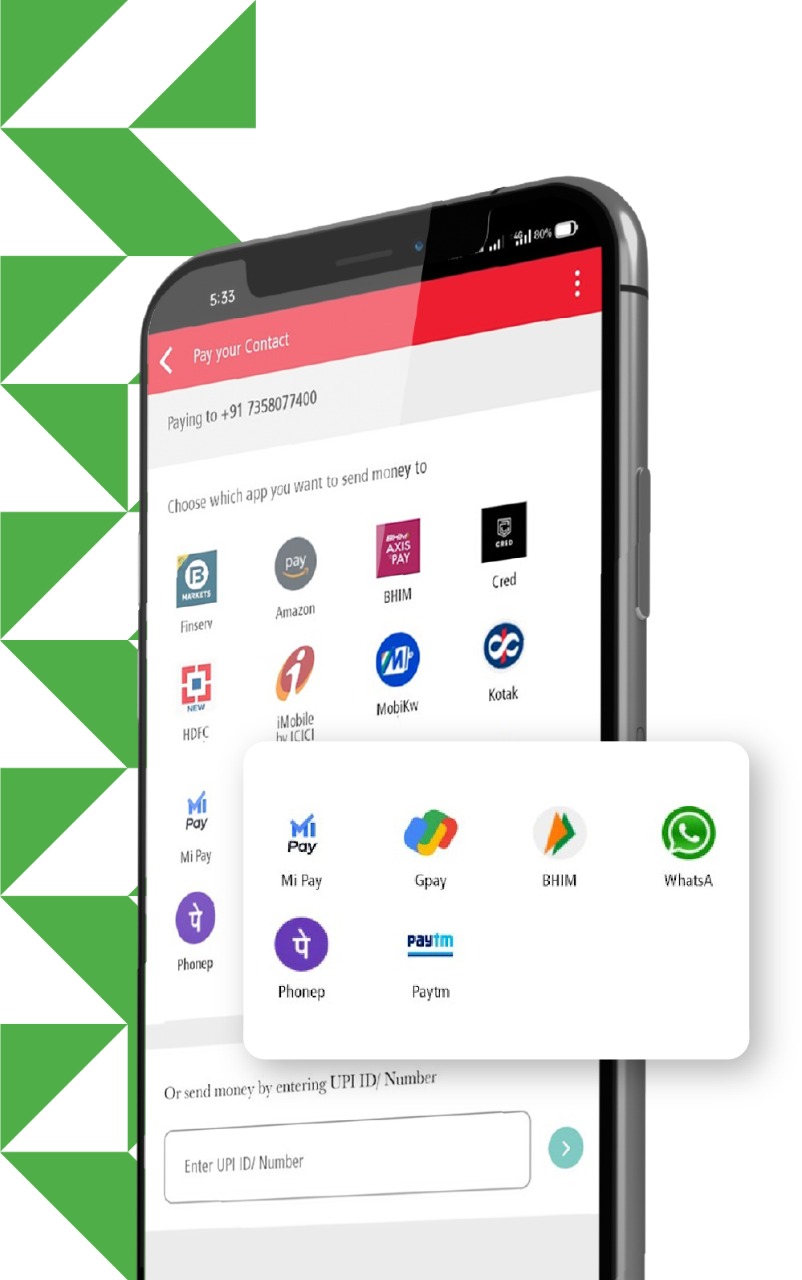

- Evolved from a simple transactional mobile banking app to a Super App that supports the integration of 3rd parties and partner ecosystems to offer a wide spectrum of banking and non-banking offerings to the customer

- Admin console enabled device, product features, user management and transaction limits, with provisions to dynamically manage messaging layer across the application to meet ever-changing compliance and new feature additions with multilingual support

- SSO for 3rd party solution providers to embed the bank payment solutions

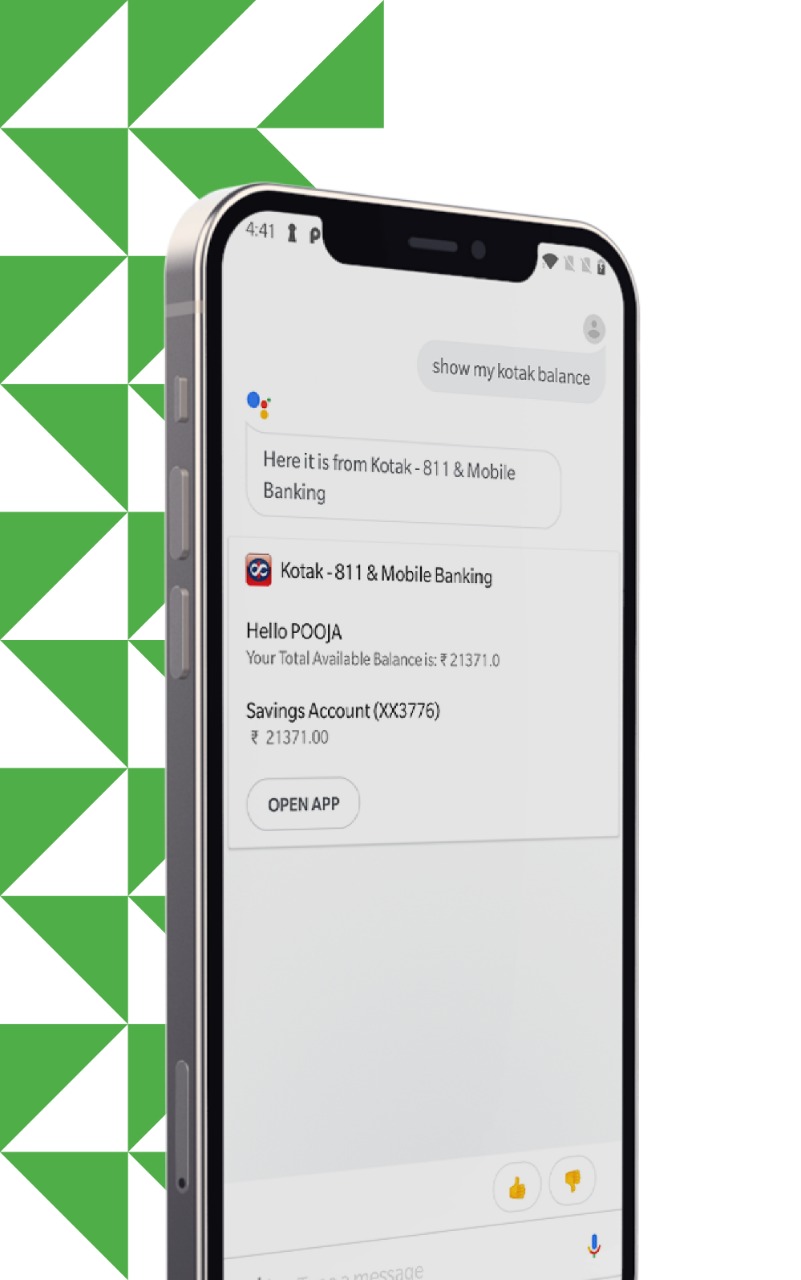

- Developed Voice Banking through Apple Siri and Google Assistant for an out-of-the-app experience

- COE team for continuous development and support to meet ever-changing business needs and consumer behaviour.

A Trusting Partnership

Serving the fintech sector for more than 15 years, we understand the client requirement for Digital Acceleration solutions powered by Experience Engineering. Our capabilities in the BFSI sector perfectly blend our unmatched experience in the market, technological capabilities and ability to mould as per client requirements.

We have an award-winning team of experienced consultants and development experts who provide an extensive range of services to the BFSI clients. Here’s why the clients partnered with us to deliver them business growth:

- Strong experience servicing some of the top financial services worldwide

- Fintech Focused

- End-to-end service offerings include Solution Consulting, UI/UX engineering, Backend Engineering, API Augmentation, Native and Hybrid Application Development, DevOps, Quality Assurance and Infrastructure monitoring.

A Trusting Partnership

Serving the fintech sector for more than 15 years, we understand the client requirement for Digital Acceleration solutions powered by Experience Engineering. Our capabilities in the BFSI sector perfectly blend our unmatched experience in the market, technological capabilities and ability to mould as per client requirements.

We have an award-winning team of experienced consultants and development experts who provide an extensive range of services to the BFSI clients. Here’s why the clients partnered with us to deliver them business growth:

- Strong experience servicing some of the top financial services worldwide

- Fintech Focused

- End-to-end service offerings include Solution Consulting, UI/UX engineering, Backend Engineering, API Augmentation, Native and Hybrid Application Development, DevOps, Quality Assurance and Infrastructure monitoring.

How We Drive Excellence

Providing them with a full spectrum of digital services, we had an opportunity to improve business efficiency, making it simpler and faster. We engaged with them on everything Digital, from UI/UX design, software development, and platform modernisation to product development. Our hand-picked team of Domain Experts, Technology Consultants, and Experience Engineers facilitate the digital journeys, and our dedicated team offers round-the-clock support through every stage.

Shaping Organisational Growth

The business outcome of our strategic partnership helped the bank redefine its digital presence and consumer banking with the following:

- A zero-contact for a complete digital acquisition

- Revamped net banking and mobile app with a clean and refreshed UI/UX for retail customers

- Voice banking makes it easier for customers to reach out

Direct Business Benefits

- 72% growth in transaction volume on a mobile app

- 275% increase in retail customers after introducing a new customer self-onboarding module in 2017

- 10 Million + app downloads – Making it one of the top mobile banking apps in the country

- Consistent 4.3+ ratings in the app store

Shaping Organisational Growth

The business outcome of our strategic partnership helped the bank redefine its digital presence and consumer banking with the following:

- A zero-contact for a complete digital acquisition

- Revamped net banking and mobile app with a clean and refreshed UI/UX for retail customers

- Voice banking makes it easier for customers to reach out

Direct Business Benefits

- 72% growth in transaction volume on a mobile app

- 275% increase in retail customers after introducing a new customer self-onboarding module in 2017

- 10 Million + app downloads – Making it one of the top mobile banking apps in the country

- Consistent 4.3+ ratings in the app store

If this use case inspires you to redefine the Customer Experience of your mobile banking app for business and revenue growth, then we would like to chat with you

;)